An Overview of IRS Form 990-T:

What is IRS Form 990-T?

Form 990-T is an annual return filed by specific tax-exempt entities and charitable organizations to provide the IRS with information regarding income they generated from unrelated business activities.

Who Must File Form 990-T?

Organizations that file Form 990 or 990-EZ and have an unrelated business income totaling $1000 or greater are obligated to file Form 990-T.

When is the Deadline for filing your IRS Form 990-T?

| Organization Type |

Form 990-T Deadline |

|---|---|

|

15th day of the 4th month |

|

15th day of the 5th month |

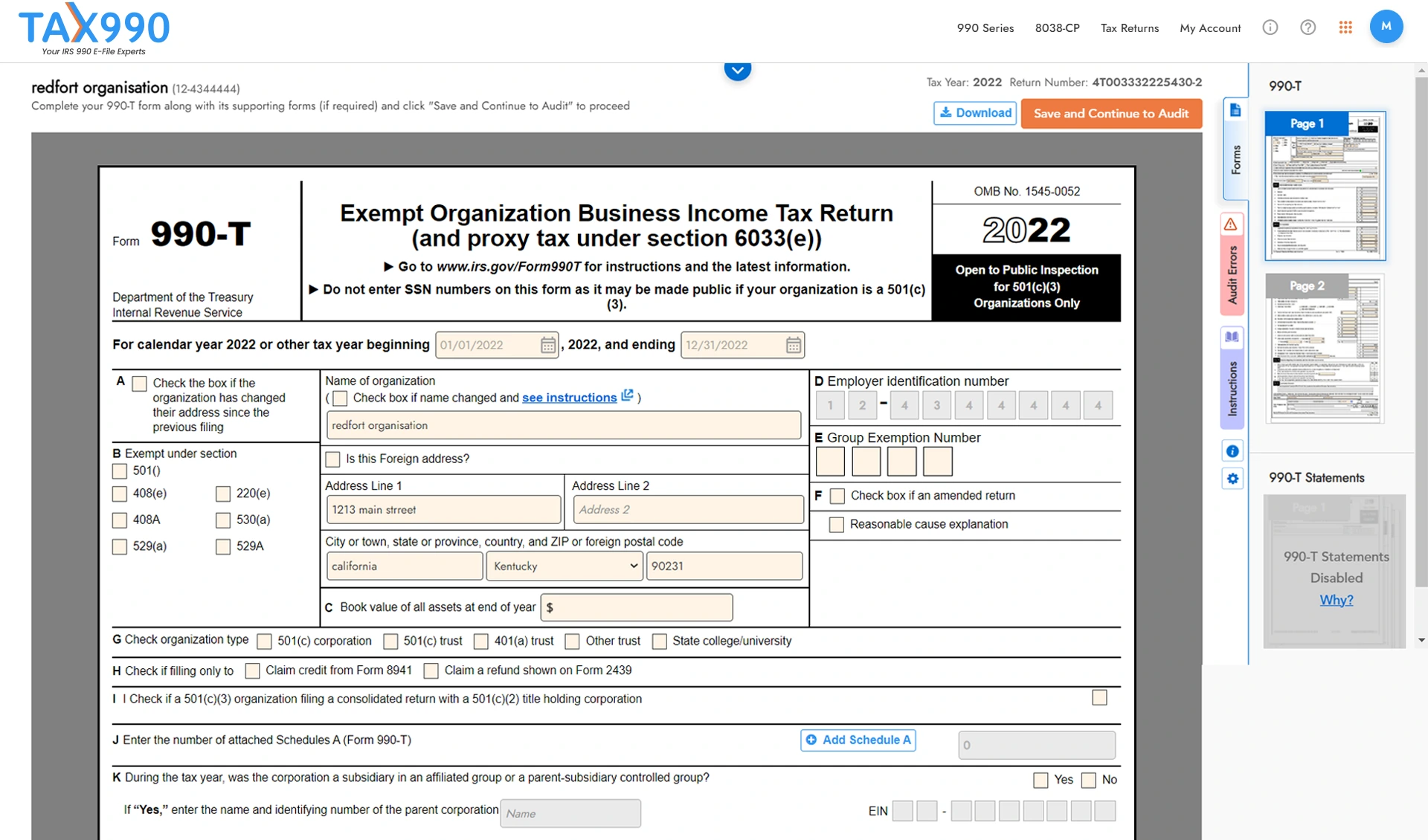

Information Required to File

Form 990-T:

-

Basic Details about their organization

Detailed Information about their Unrelated Business Income (UBI)

Tax computations, taxes, and their payments

Other activities of the organization

Additional Requirements to File Form 990-T

-

Organizations that submit Form 990-T must include Form 990-T Schedule A, which is essential for reporting specific information about each of the unrelated businesses or trades they have disclosed.

Separate Form 990-T Schedule A should be attached for each individual

business or trade.

Enables Seamless 990-T E-Filing with Exclusive Features

Includes all 990 Forms

Form-Based Filing

Internal Audit Check

Supports Multiple-user Access

Supports Form 990-T

Schedule A

Live Customer Support

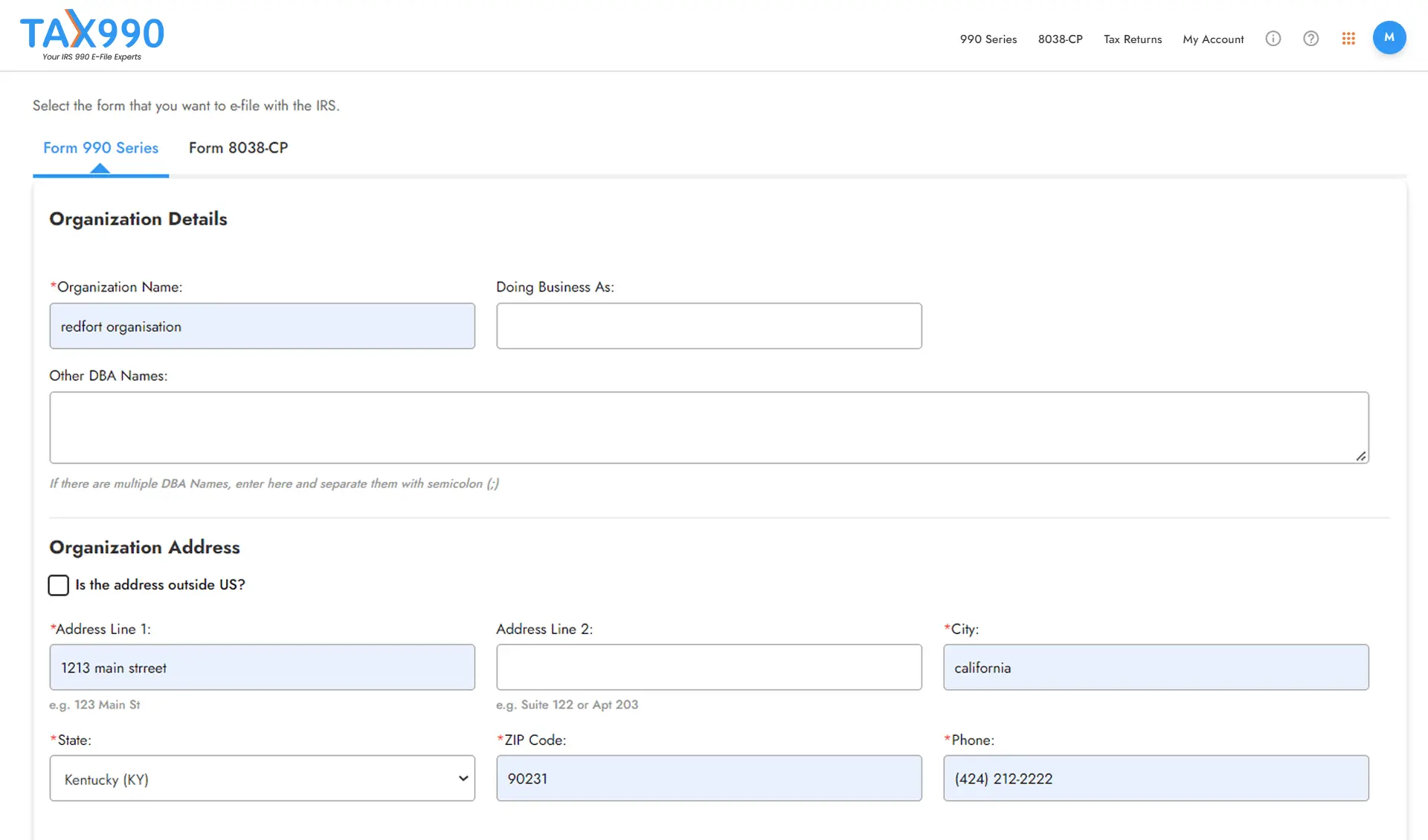

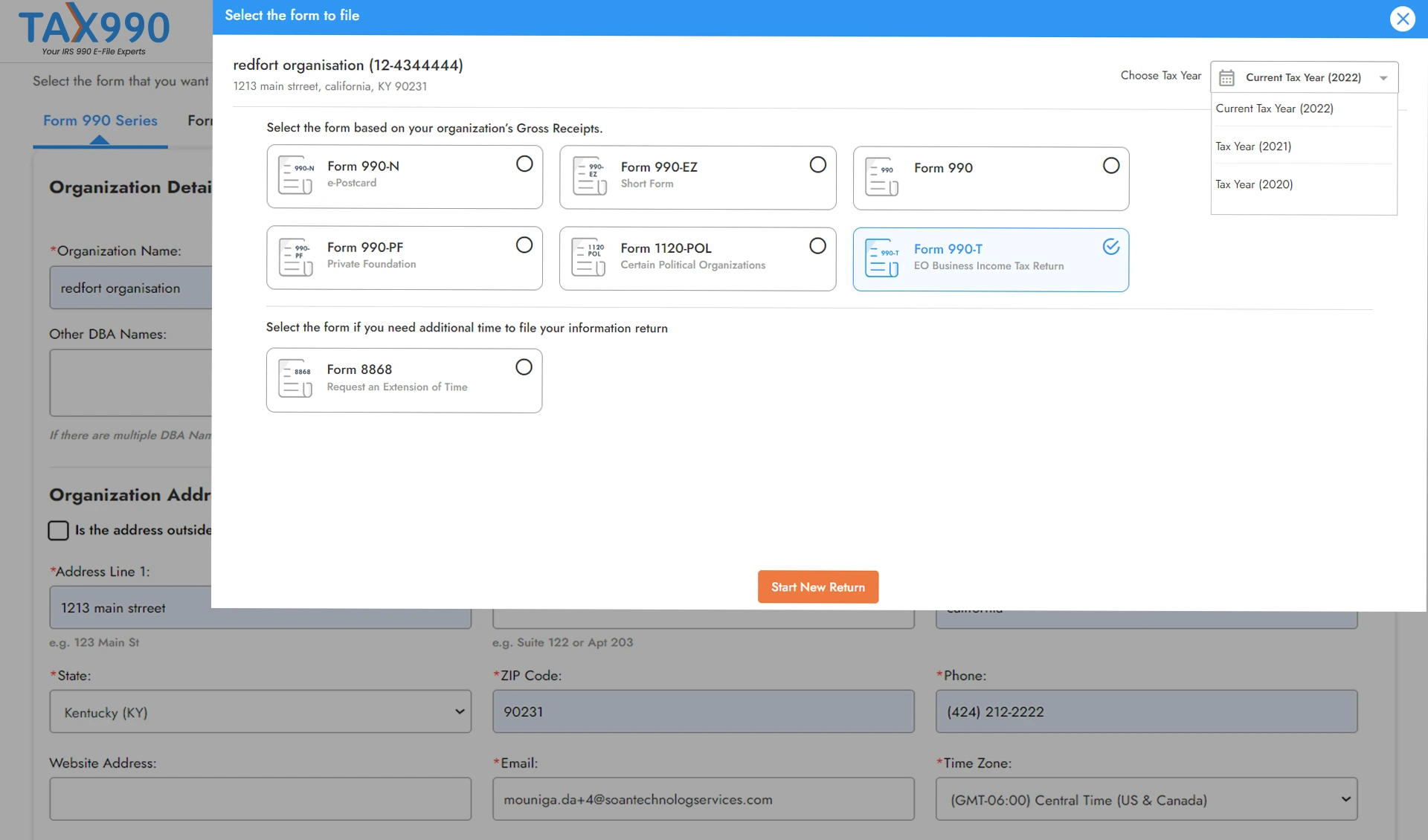

How to File Form 990-T Electronically with Our Software

-

Search for your EIN to import your organization’s data automatically from the IRS or enter manually.

-

Tax 990 supports filing for the current and previous tax years. Choose the tax year of your preference, select Form 990-T, and proceed.

-

Choose from Form-based or Interview-style, depending on how you would like to provide the form information.

-

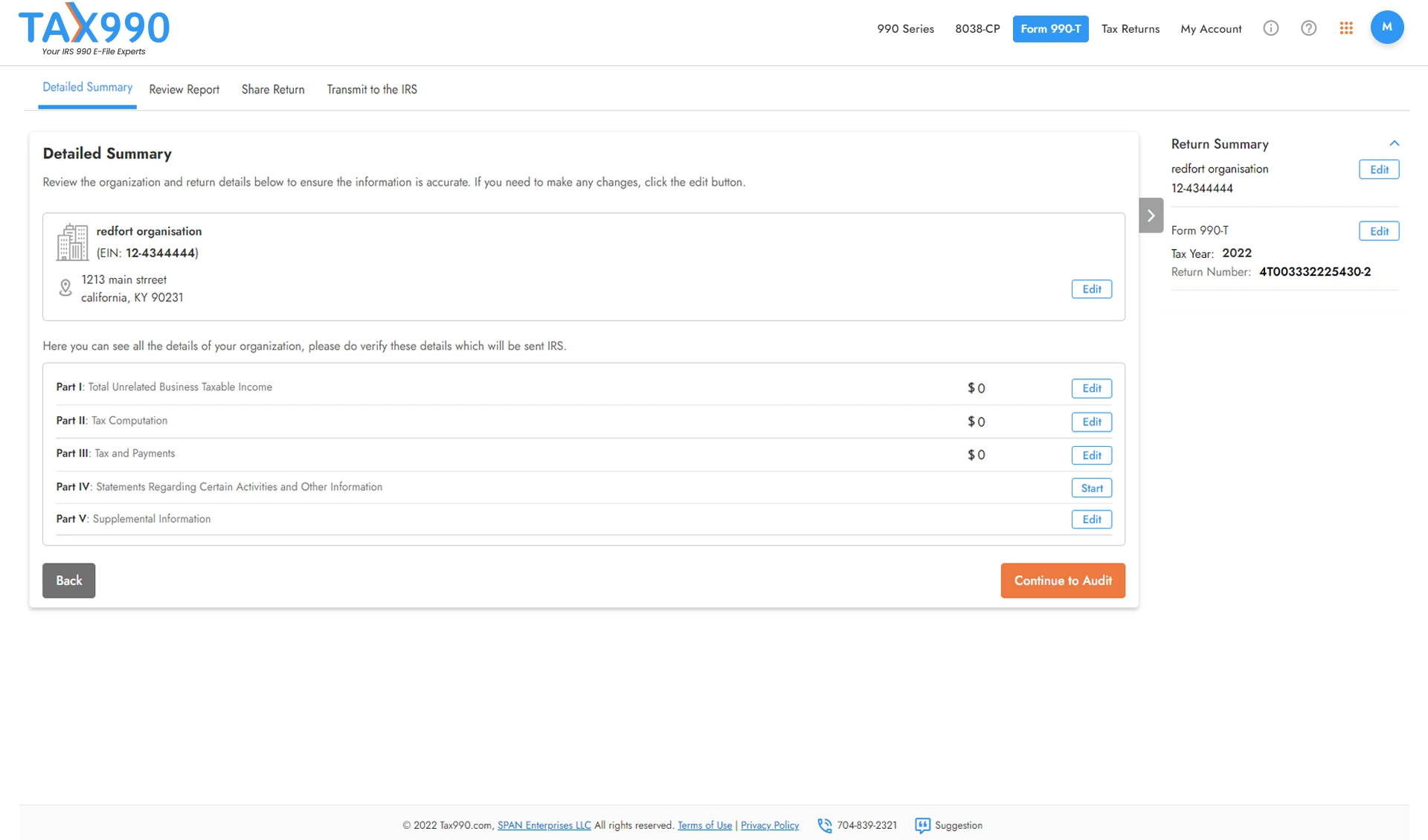

Review your form summary and make any necessary changes. You can also share your form with team members for review and approval.

-

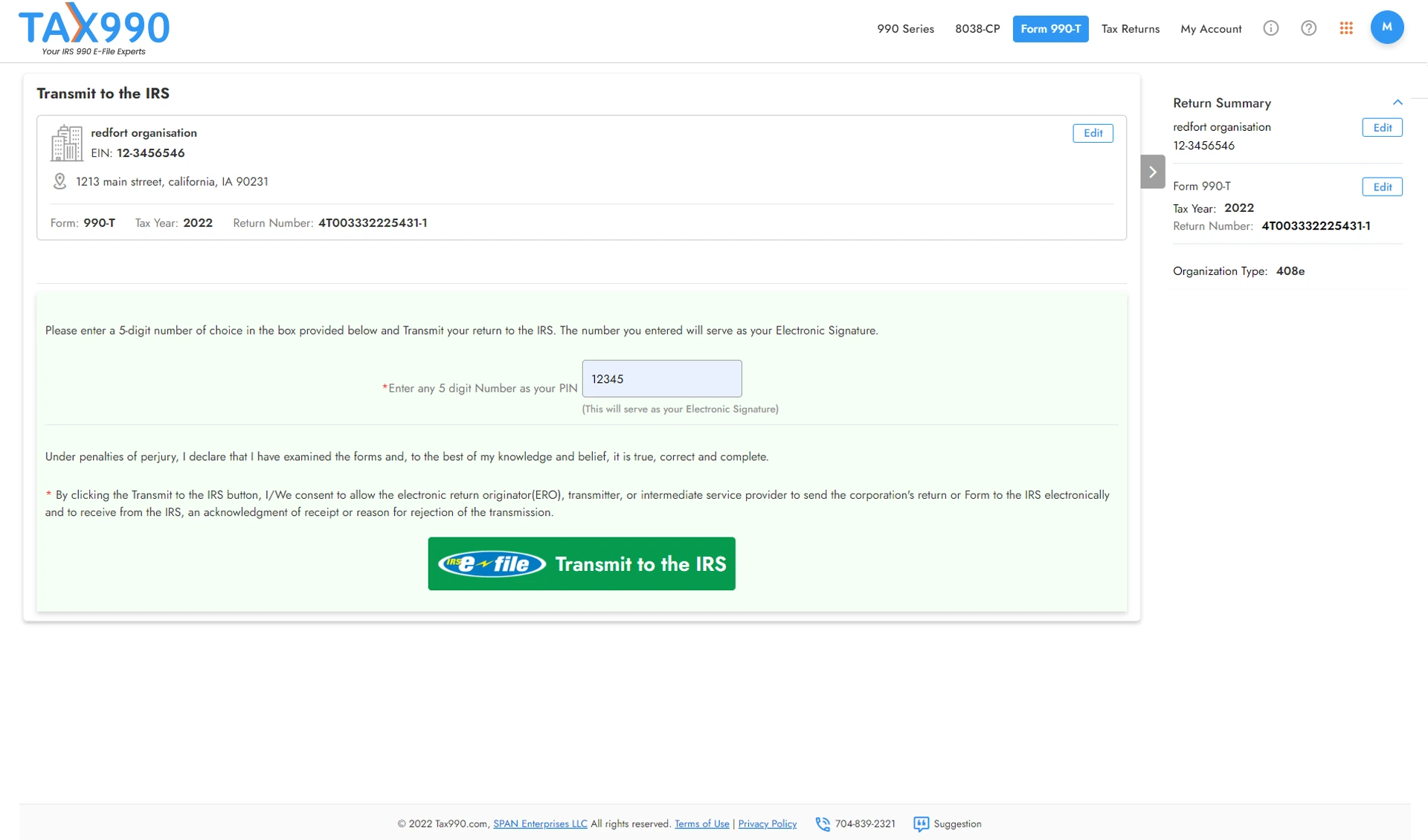

After you review your form, you can pay and transmit it to the IRS. Our system will provide status updates for your form via email or text.

Pricing to File

IRS Form 990-T

- Includes Form 990-T Schedule A

- Supports other 990 forms

- Invite your staff to handle the filing process

- Live chat, phone, and email support

E-file your Form 990-T for $99.90 per return

E-file your Form 990-T for $99.90

per return

Helpful Resources

Form 990-T Instructions

Learn More

Form 990-T Due Date

Learn More

Form 990-T Due Date Calculator

Learn More